Income Statement is used to show business done by a company in one year.

One formula can conclude the whole income statement.

Revenue - Expense = Profit

For example, you own an company which selling apple. After one year, 1000 apples are sold with 2 dollar each.(Revenue= 1000 x2=2000) Suppliers provide apples with 1 dollar each. Salary for worker is 100 dollar per year and electricity cost per year is 50 dollar. (Expense= 1000 x1+100+50=1150) Your company earns a profit of 850 dollar. (Profit = 2000-1150 =850)

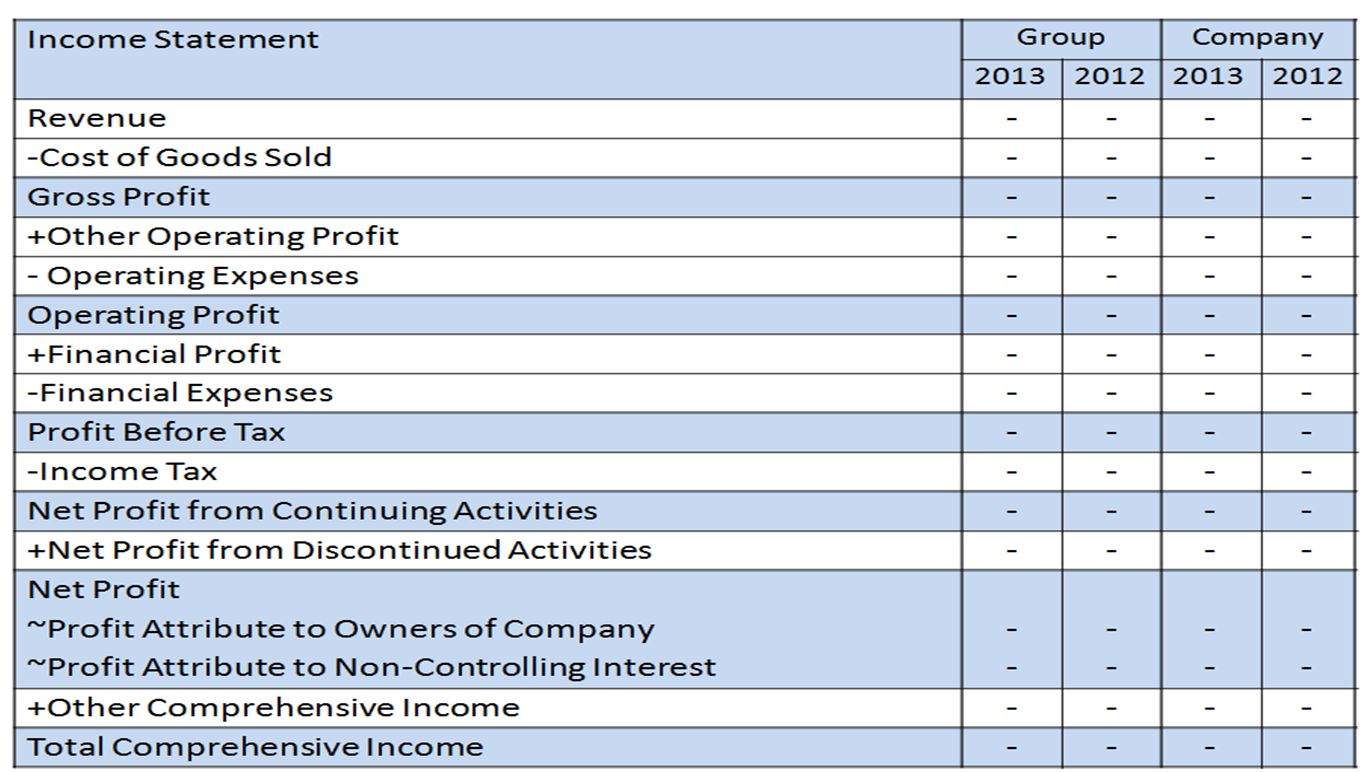

Income Statement Template

Components of Income Statement:

1) REVENUE : Price x Quantity

2) COST OF GOOD SOLD : Direct costs involved in producing products. Examples are materials, direct labour, factory overhead such as electricity bill and depreciation of machines.

3) GROSS PROFIT : REVENUE - COST OF GOOD SOLD

4) OTHER OPERATING PROFIT : Other incomes from direct sales of products such as sales of electricity and rental fees from unused spaces from building used for operation.

5) OPERATING EXPENSE : Indirect expense incurred other than direct cost such as general & administrative expenses, sales & distribution expenses, promotion expenses, research expenses.

6) OPERATING PROFIT : GROSS PROFIT + OTHER OPERATING PROFIT - OPERATING EXPENSE

7) FINANCIAL PROFIT (also called Non-Operating Profit) : Profit that are generated from non-operating activities. Examples are interest received, gain from selling securities.

8) FINANCIAL EXPENSE (also called Non-Operating Expense) : Expense that are not included in operating activities. Examples are interest paid, lost from selling securities.

9) PROFIT BEFORE TAX (PBT) : OPERATING PROFIT + FINANCIAL PROFIT - FINANCIAL EXPENSE

10) INCOME TAX : Tax paid to government based on profit before tax (or more accurate taxable income)

11) NET PROFIT FROM CONTINUING ACTIVITIES : PROFIT BEFORE TAX - INCOME TAX

12) NET PROFIT FROM DISCONTINUED ACTIVITIES : Gain/ Loss from liquidating one of the sectors of the company

13) OTHER COMPREHENSIVE INCOMES : Mainly consist of three factors that not added into the profit. Examples are Gain/ Loss from foreign currency, gain/loss from hedging, unrealised gain of available-for-sales securities.

14) TOTAL COMPREHENSIVE INCOMES : NET PROFIT + OTHER COMPREHENSIVE INCOMES

Very nicely created this income statement! Using the right type of formula is the key to prepare such statement nicely. If you've struggled to figure out whats driving your expenses, take a look at this analytics software (finance summary module from PanXpan). It helps you research and share your business's expenses and revenue with your team.

ReplyDeleteMany Thanks for Your Blog Post. Good Resource for All.

ReplyDeleteI am satisfied that you simply shared this useful information with us.

ReplyDeleteFinal Expense Leads

Sometimes in life there are genuine

ReplyDeleteshortcuts.

Shortcuts which can be life-changing

and in this case transform your wealth.

But even shortcuts require a level of

discipline and focus.

This opportunity is one such shortcut:

http://five-minute-profit-sites.net?SLLO541

It requires setting aside a minimum of

23 minutes a day.

That might sound like nothing but

in my experience most people struggle

to go 23 minutes without checking their

phone.

I want you to promise me something.

Go to this private page right now and

decide if this is the kind of shortcut

that fits with your lifestyle and mindset:

http://five-minute-profit-sites.net?SLLO541

The financial reward from this small

time investment could literally change your life.

Please let me know how you get on."

Good Blog, thanks for sharing this information.

ReplyDeleteOracle Fusion Financials Online Training